The Perception Gap was revealed in the latest Financial Services Council (FSC) research series, Money and You, and for insurances there was a 22% difference between the perception of financial confidence and the reality of financial literacy.

Here we investigate the Perception Gap for life insurance, and some of the reasons why nearly all New Zealanders insure their homes and cars, but not their income, perhaps the greatest asset over a lifetime. This research supports the Blueprint for Growth policy focus that aims to ensure that Kiwis better manage and understand their risk through being adequately insured.

There are several risks in life, including natural disasters, loss of income, and sickness. Insurance policies can protect New Zealanders and dependents and reduce financial loss should the worst happen. While 98% of homeowners have insured their home, and 95% of car owners have insured their car, just 20% of New Zealanders have insured their income against sickness or disability.

The research suggests it’s a tough conversation:

- We don’t like to talk or think about the things that could impact our personal or family financial situation, like injury or death.

- Many are unsure about the benefits of insurance and how to manage financial risk, where to get advice or are unable to afford the premiums.

- Some are happy to self-insure, or rely on Government to reduce financial risk through schemes like ACC.

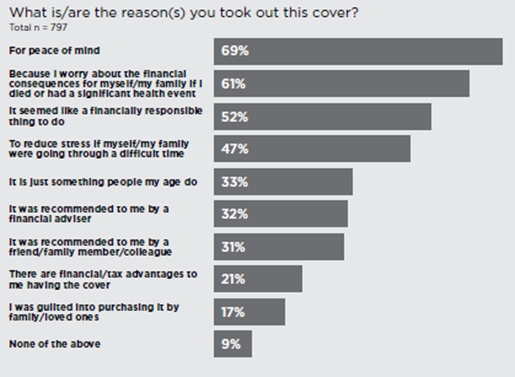

Those with life insurance cover see the positives such as:

- giving peace of mind and removing worry about the financial consequences of death or a significant event

- a financially responsible thing to do that reduces stress from loved ones through a difficult period.

Latest FSC data* shows that the New Zealand life insurance industry supports around 4.1 million life insurance policies that include trauma, disability, and income insurances, and last year paid New Zealanders around $1.2 billion in claims to support them when they most needed it.

Looking at the three types of life insurances, the research revealed that New Zealand is underinsured, with just:

- 22% reported having trauma/critical Illness Insurance,

- 20% reported having income insurance should they lose their job, and

- 17% reported having total and permanent disability insurance.

The Perception Gap saw 82% of respondents self-reported financial confidence, yet many aren’t managing their income risks effectively by utilising the protection provided by life insurances.

The top five circumstances that would see respondents take out a life insurance policy to cover income include:

- affordability

- change of life stage (e.g. starting a family)

- if it was simpler to understand and apply and better explanation of the benefits of insurance.

Figure 1: What is/are the reason(s) you took out this [life insurance] cover, Money & You – The Perception Gap, November 2023

Looking at the data across different age groups, it is more likely that: 29 – 57 year olds will hold life insurance products with older generations, those 58 or older, more likely to have previously had life insurance, but no longer do.

New Zealand is one of the most underinsured nations in the OECD and our levels of risk are only increasing, putting at risk our hard-earned income. Insurance plays an important role in spreading the costs of risk that helps to ensure financial stability for New Zealanders through unexpected and difficult times.

*This article is based on the research Money & You – The Perception Gap which is available here.