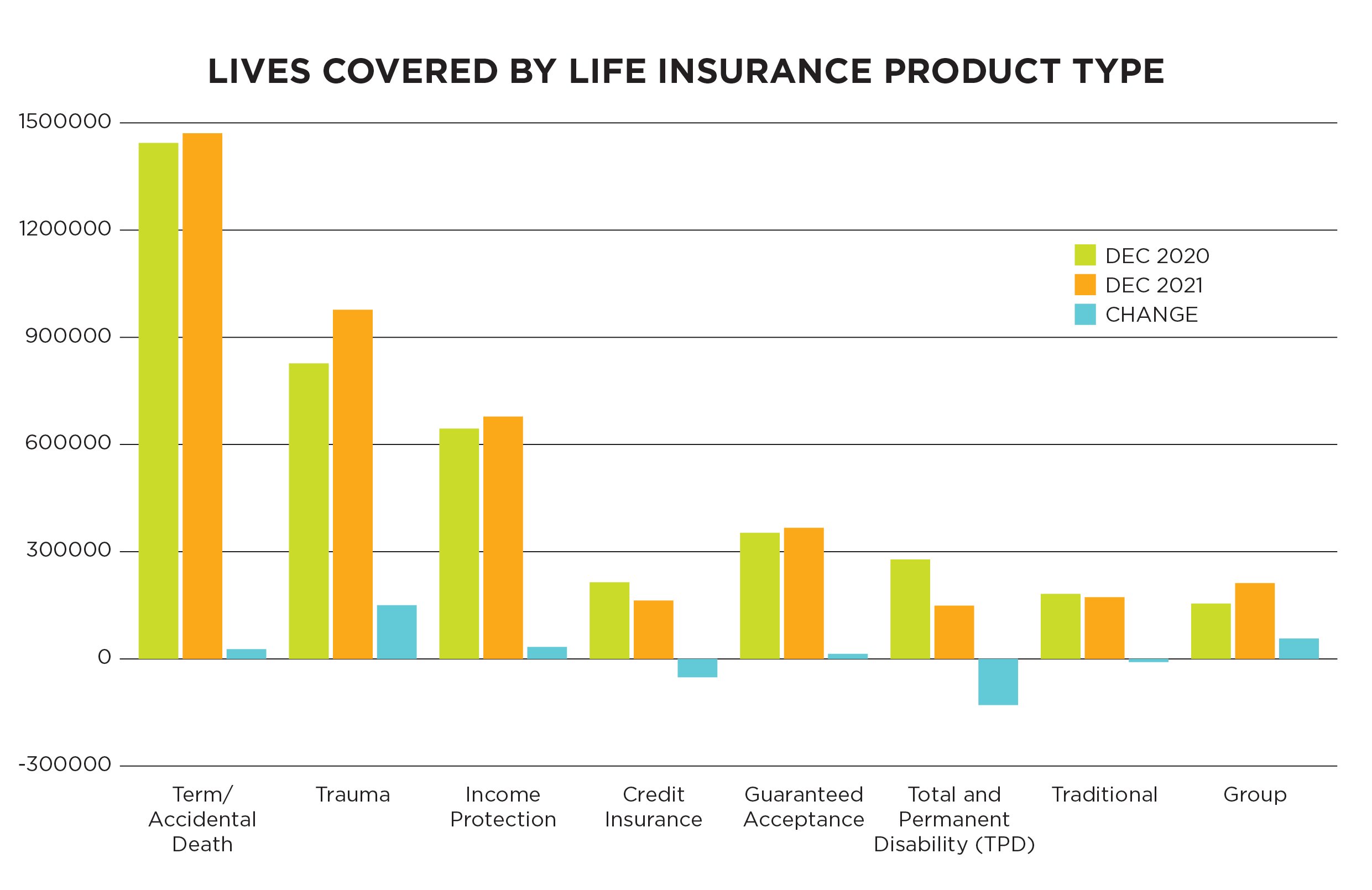

The latest data snapshot released today by the Financial Services Council (FSC), shows another solid year of meeting customer needs for the life insurance sector, with the number of life insurance covers increasing by 92,000 to 4.2 million over 2021.

The data snapshot also shows that the sector paid out $308 million in claims in the last quarter of 2021 and that 96% of claims made over the same period were paid.

Richard Klipin, Chief Executive Officer of the Financial Services Council, said “As we saw in the FSC health insurance data released last week, Covid-19 looks to be having a similar impact on families looking to protect their financial wellbeing and better manage their risk with insurance products through these uncertain times.”

The changes by product type shows the positive net growth and indicates active consideration of changing cover needs by customers and their advisers, for example the apparent movement from Total and Permanent Disability (TPD) to broader and more comprehensive Trauma covers.

Nick Stanhope, co-chair of the FSC Life Forum, said “Of interest is the growth in group insurance cover.

This is a similar trend we have seen in other data, where employers are looking to dodge the ‘Great Resignation’ trend across the world and mitigate recruitment issues caused by New Zealand’s tight labour market, by offering added incentives to retain their teams,” added Stanhope.

Naomi Ballantyne, co-chair of the FSC Life Forum, said “Life insurance is designed to be there when unexpected events happen, and with 96% of all claims paid in the last quarter of 2021 by FSC members, it demonstrates the industry’s commitment to support customers in some of the most difficult and challenging life situations.

"I would like to thank all the FSC members and their teams that have continued to support changing customers’ needs, whilst themselves adapting to different working patterns and the uncertainty of the pandemic,” added Ballantyne.

“As we continue to move through the latest Omicron surge, it is encouraging to see that more New Zealanders are thinking about their financial resilience and wellbeing.” concluded Klipin.