The Financial Services Council (FSC) has released its latest Money & You research showing that 69% of women do not feel financially prepared for retirement.

Richard Klipin, Chief Executive Officer, FSC said, “The reality is that an estimated 2.3 million or 56% of New Zealanders aged 18 or over aren’t financially prepared for retirement, and the majority are women.

“Investing now means having financial security, which is critical for a dignified retirement, but the majority of Kiwis are on auto-pilot when it comes to planning for the future,” continued Klipin.

The report reveals that 42% of New Zealanders are contributing the minimum 3% and the two-thirds of employers (64%) are matching that, meaning many won’t have created sufficient KiwiSaver funds for even a ‘no frills’ retirement.

Klipin said, “Although some will be prepared and have got advice from their provider or financial adviser, many just don’t know what they might need.”

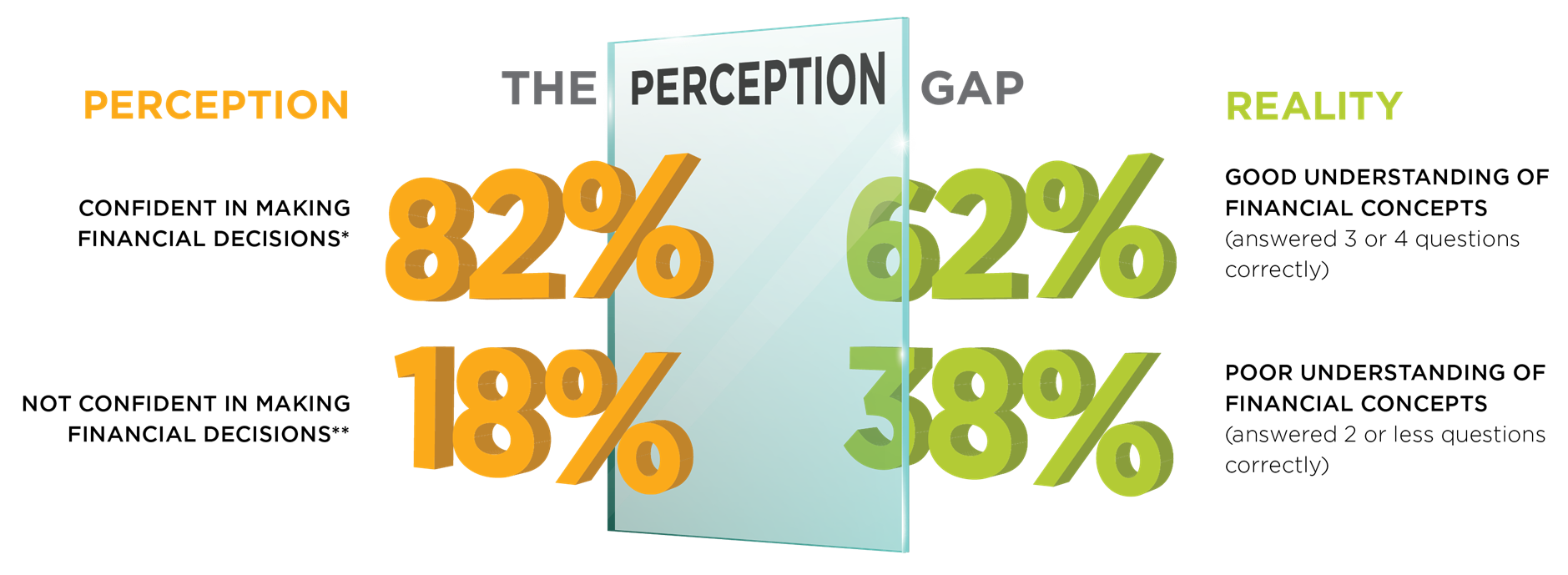

The FSC’s latest Money & You research shows that there is a general ‘Perception Gap’ that is blindsiding Kiwis financial management ability when planning for short-term and longer-term needs.

“It’s a balancing act that is harder in today’s high interest environment. Kiwis are having to manage on less day-to-day and make trade-offs between living today and saving up for a comfortable tomorrow.

“Working out where the trade-offs are means there are a bunch of pretty tricky decisions to be made, and we can be overconfident in our ability to make them”, said Klipin.

The Perception Gap is created when there is a mismatch between confidence in making financial decisions and a real understanding of financial concepts, especially when it comes to more complex decisions around managing risk, investment and retirement.

The research shows that there is a 20% gap between the number of Kiwis that perceive financial confidence (82%) and those that have a real understanding of the four financial concepts tested (62%).

Fig 1: Money & You: The Perception Gap November 2023.

“Finances can get complicated, so whether your concern is short-term cost of living or long-term investment and retirement planning, talk with whānau, your provider or an adviser and close your Perception Gap – it will help improve your financial confidence and wellbeing,” concluded Klipin.

ENDS

Top five tips to closing your perception gap

- Balance short-term day-to-day needs with a longer-term plan, you’ll be prepared and know where you are headed.

- Keep a track on your finances and set a savings goal for your desired retirement lifestyle.

- Check your KiwiSaver settings and make sure you are in the right type of fund to help build your retirement pot.

- Find out how much you and your employer are contributing to your KiwiSaver and see if you can afford to sacrifice a little more today for your future retirement.

- Seek advice and get help and support now to close your perception gap, don’t wait until it’s too late.