The Perception Gap was revealed in the latest Financial Services Council (FSC) research series, Money & You, and for insurances there was a 22% difference between the perception of financial confidence and the reality of financial literacy.

Here we investigate the perception gap for health insurance, and some of the reasons why nearly all New Zealanders insure their homes and cars, but not their health and wellbeing. The research supports the Blueprint for Growth policy focus that aims to ensure that all Kiwis have accessible and affordable healthcare.

The private health sector supports the public sector and can provide quicker access and innovation to services. There is also demand for employer based schemes to support team productivity and manage health risks at work, whether it is through injury or sickness.

It’s important that New Zealanders ‘age well’, and as such access to health prevention services have never been more front of mind.

Latest FSC data shows that the New Zealand health insurance industry supports around 1.45m New Zealanders and in the last year paid out around $1.8 billion in claims to support them to meet their healthcare costs.

Many health insurance claims relate to elective treatments, such as orthopaedic and gynaecological services, which helps to ease demand on the public health care system. Around a quarter of claims come from customers aged under 45, who claim for a range of services – from day-to-day health care costs such as dentist and GP visits, through to specialist consultations, diagnostic tests, and surgery.

Since 2020 and the Covid-19 pandemic, the industry has continued to grow with more New Zealanders opting to get and retain health cover, a similar trend to those found internationally. Despite this growth, the latest research shows that just 37% of Kiwis invest in health insurance cover.

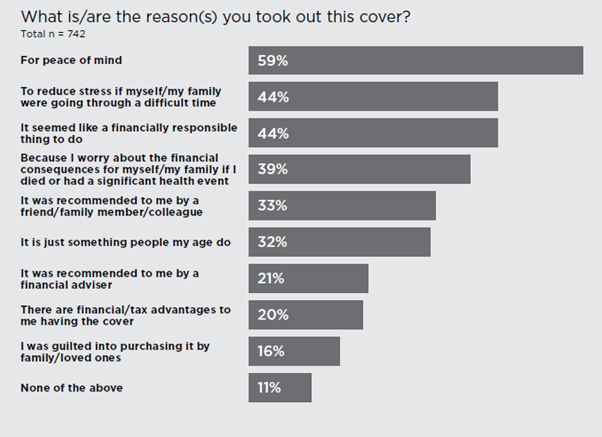

So, why invest in and protect personal health and wellbeing through health insurance? The latest research tells us that the top five reasons for doing so are;

- for peace of mind,

- to reduce stress,

- it seems like a financially responsible thing to do,

- because I worry about the financial consequences for myself/my family if I died or had a significant health event,

- it was recommended to me by a friend.

Figure 1: What is/are the reason(s) you took out this [health insurance] cover, Money & You – The Perception Gap, November 2023

Peace of mind and stress reduction are not surprising when the research reveals that, of the top health concerns, by far the most frequent is mental health and wellbeing (34%), which is significantly higher for younger generations than older. Overall, respondents also worry about concerns such as cancer (14%), heart disease (12%) and muscoskeletal conditions (9%).

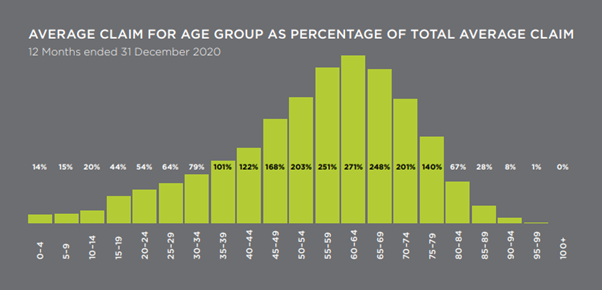

Delving further into the generational differences, data from 2020 shows that average claim levels for those with health insurance start from newborn and steadily grow to a peak around the age of 60-64, showing that all age groups benefit from health insurance support.

Figure 2: Average claim for age group as percentage of total average claim

Health insurance cover protects our families when the unexpected happens and should be a key consideration when thinking about managing the potential loss of income that a significant health event might create in your household.

A well balanced and integrated health system is key to achieving and supporting great customer and patient outcomes, and the FSC and its members are committed to support the provision of accessible and affordable healthcare alongside the ACC and public health system.

This article is based on the research Money & You – The Perception Gap which is available here.